Insurance Ads: How to Find More Customers

Insurance ads provide a great way to connect with more clients and make more money. Finding ways to advertise is easier than you might think — you just need to know where to look. A well-run advertising campaign will increase your revenue, so it’s important to make the most of the options available. In this article, you’ll learn about paid, free, and low-cost options of insurance advertisement. This includes:

- Paid insurance ads options

- Google Ads

- Facebook and Instagram ads

- Yelp ads and other directories ads

- Free and low-cost insurance ads options

- Active social media presence

- List your business on popular sites like Google or Yelp

- Email marketing as direct advertising

Find more leads and drive policy renewals with expert marketing advice and all the tools you need, all in one place.

Paid insurance ads options

One of the quickest ways to connect with new clients is through paid insurance ads. There are different places you can post these ads, but they all work the same way: you pay money to a company to post your ad on their platform. You will either pay them for every customer who clicks your link or for every person who sees your ad. Your industry, the location of the ad, and the level of interaction with your ad will determine the cost of a paid insurance ad.

Google Ads

Google is one of the most popular places for insurance advertising. That’s largely due to its Google Ads platform, which places a company’s name and website on the very first page of search results whenever someone searches for a keyword related to the company. Running a round of Google Ads for your insurance company works because so many potential customers use Google every day.

To know whether or not a company has a Google Ad, look at the words next to the search result. If the word “Ad” appears in bold, that indicates a Google Ad. When it comes to success in search engines, the higher your post is on a Google search results page, the more likely a customer is to click it. Having a Google Ad means your company is more likely to sit at the very top — a difficult task to do on your own.

If you’re not sure how to create a strong Google Ad, check out this simple tool from Constant Contact to help you get started.

Facebook and Instagram ads

Social media platforms help people burn some free time and relax. But they’re also great places to put insurance ads. Both of these platforms have millions of users online every day. Having an ad appear as they scroll through their newsfeed gives people a chance to learn about you and perhaps be curious enough to click your ad and get in touch.

Additionally, Facebook and Instagram do a great job of segmenting their users. It means that you can send out a hyper-targeted ad to certain ages, genders, locations, and people who follow certain pages and like specific content.

The amount of data that you can use in your ad is overwhelming if you don’t know where to start. Constant Contact also has a tool to optimize your Facebook and Instagram ads. An optimized ad makes you the most possible money.

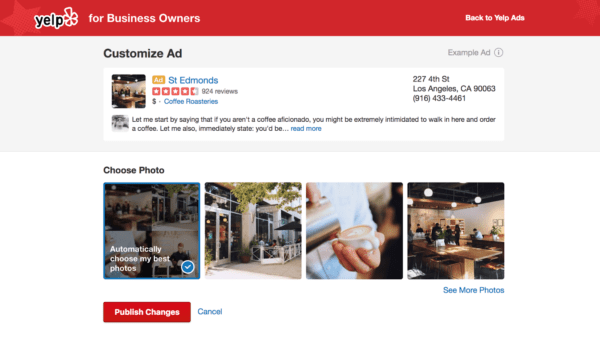

Yelp ads and other directories ads

Besides Google, customers might also search Yelp for an insurance company in their area. Lucky for you, Yelp is another platform that allows you to post your insurance advertisement. Just like Google, your Yelp ad appears like a normal search result with small text that indicates it’s an ad. This ad will bump your insurance company’s listing to the top of the pile. It will link to your website and phone number.

Free and low-cost insurance ads options

Even though paid options offer you many different advertising opportunities, you can also find free or less expensive advertising options that benefit you. The following options are free or low-cost ways to get more customers. They take longer to see results and require more effort, but they also lead to success if applied.

Active social media presence

Going back to social media, you don’t need to pay to advertise. You can blast your insurance company’s name all across social media just by having an active presence. In today’s constantly connected society, having an active social media page is one of the best ways to grow your insurance company without spending any money.

To have a successful social media presence, make sure you’re posting shareable content often. People love telling others about what they’ve read or who they’ve worked with, and social media offers a way to do this with hundreds of people through every post. If you have a blog or website, include links to them in your posts. This way you’re advertising your company while engaging with your audience and familiarizing them with who you are and what you do.

Use your company’s voice and brand on all of your social media accounts. Give out free information that can help people make informed decisions in the world of insurance. You might also get into content creation and put together some shareable infographics. Whatever your method is, the goal is to get a faithful following for your accounts, and through that following, more clients.

Your followers are all potential leads. If they enjoy the content you share you’re likely the one they’ll contact when they have insurance needs. And if they really like your content, they’ll share it with their contacts, which makes their contacts potential leads as well — it’s a snowball effect that can gather you more leads and potential clients.

List your business on popular sites like Google and Yelp

If your business is listed on Google and Yelp, you’re off to a great start. A listing acts as an advertisement even though it’s not one officially. It contains your company’s website, phone number, and address — all ways people can interact with you and learn about what you’re doing and how you can help them.

However, making your listing is just one step to advertising your business online. Another step is optimizing it and getting reviews. Managing the reviews on your insurance company’s listing will help convert searchers as they see your listing.

Featuring many 5-star reviews and kind words will encourage a searcher to visit your site and learn more. If your site has the right information, then a searcher may get in touch. On the other hand, poorly managed Google and Yelp listings can drive people away before you even have a chance.

Email marketing as direct advertising

Email marketing is a low-cost direct advertising option. It lets you connect with your customers and market to them at the same time. This is a perfect way to make a customer or lead feel special. Through email marketing, you can target your audience directly, and even design special offers for them to share with their family and friends — referring you to others and possibly gaining new clients.

To start, you need to make an account with an esteemed marketing platform. From there, you’ll enjoy a long-term, low-cost solution to get your message across.

Your email marketing campaign can take many different forms. At its core, however, you want to make sure that your campaign is built around connecting with the right people and selling your services appropriately.

Your mailing list targets customers, potential customers, and leads. By saying the right things to the right people, at the right time, you can turn the whole list into a roster of loyal customers. Use your database of emails to advertise your insurance company. The basic ideas of insurance email marketing are pretty simple.

Start Now

Now that you know about your online advertising options, why not start advertising your insurance company today? Insurance ads will help build brand awareness and let people know about the great services you offer. For more online marketing help, check out The Download, Constant Contact’s ultimate online marketing guide.

The post Insurance Ads: How to Find More Customers appeared first on Constant Contact.